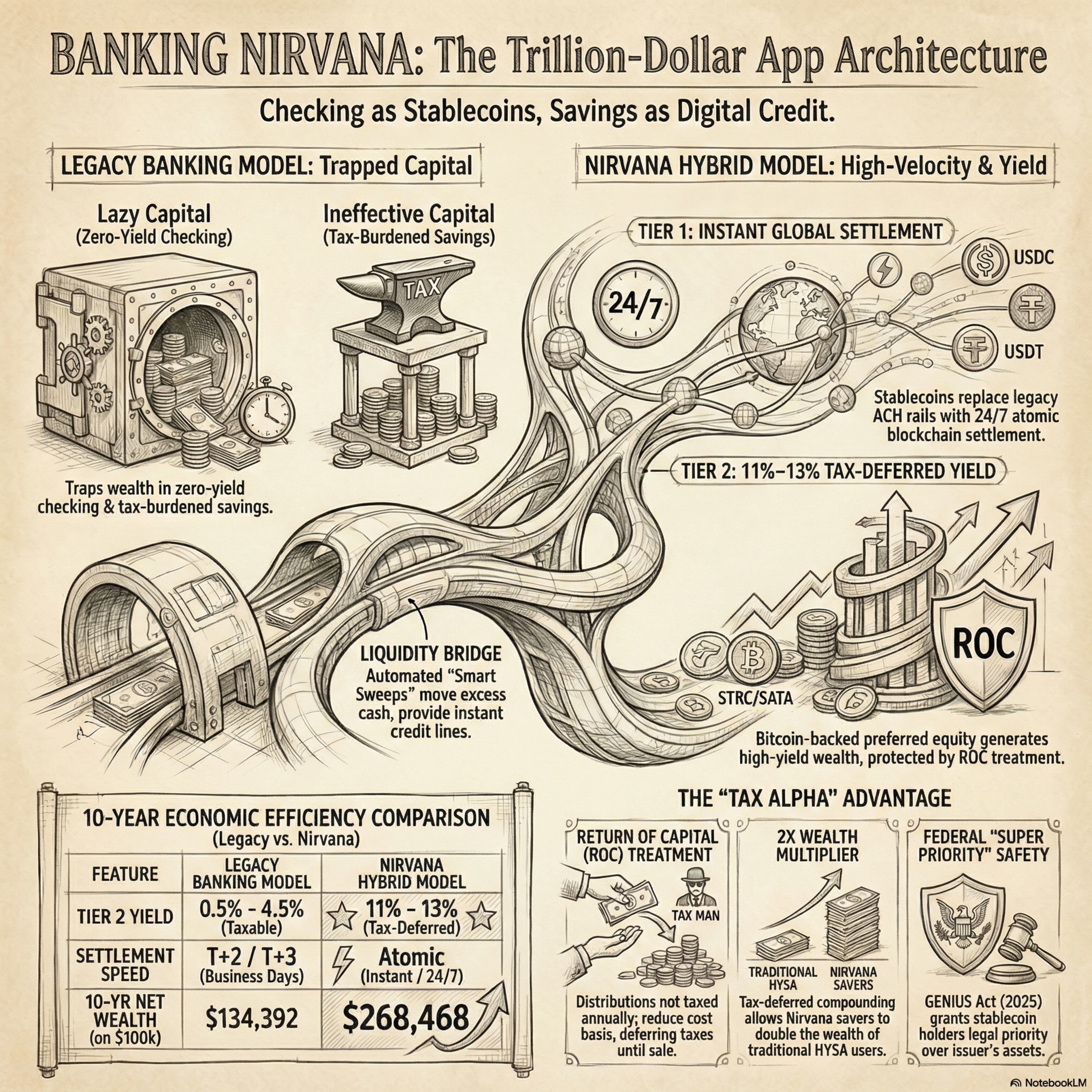

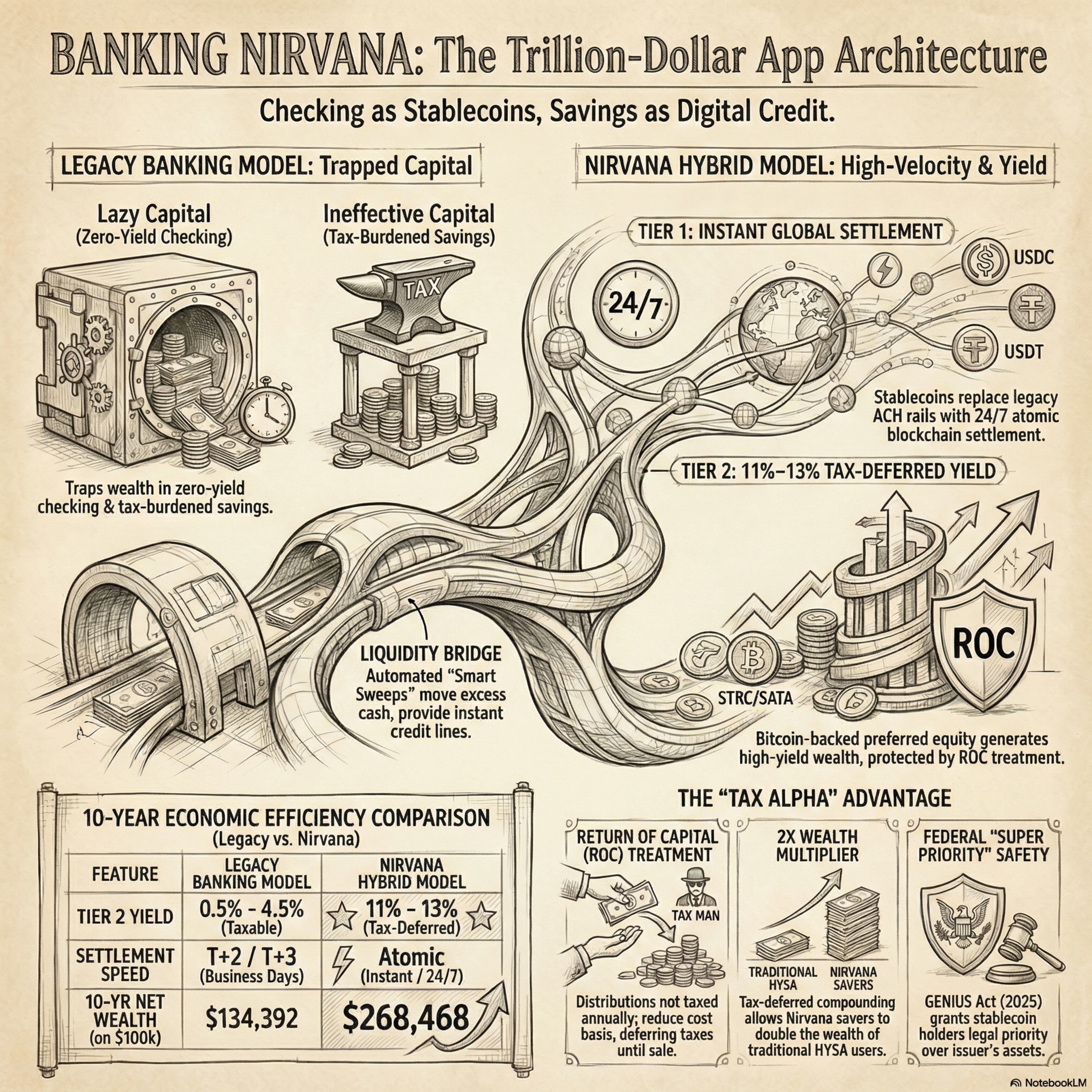

A trillion dollar Banking App - checking as Stable Coins and Savings as Digital Credit !

EpisodeFeb 1034m

Research Paperemail: amj@shutri.comThe Episode outlines a revolutionary financial framework called Banking Nirvana, which proposes replacing the antiquated checking and savings model with a high-performance two-tier digital architecture. The first tier utilizes stablecoins to provide a high-velocity transactional layer for instant, global payments that bypass the delays of traditional bank clearing. The second tier introduces Digital Credit, an asset class of preferred equity backed by Bitcoin treasuries that offers double-digit yields and significant tax advantages through return-of-capital treatment. By leveraging new legal frameworks like the GENIUS and CLARITY Acts, this model aims to bridge the gap between blockchain efficiency and regulated securities to maximize consumer wealth. Ultimately, the text argues that the first fintech to integrate these complex rails into a seamless user interface will lead a massive migration of capital away from legacy institutions.The Core Concept#BankingNirvana#FutureOfBanking#FintechRevolution#Tier1Tier2#KillTheBankAssets & Technology#Stablecoins#DigitalCredit#BitcoinTreasury#AtomicSettlement#ProgrammableMoney#USDC#SolanaFinancial Strategy & Yield#TaxAlpha#ReturnOfCapital#HighYield#SmartSweep#LazyCapital#IneffectiveCapital#BitcoinYieldLegislation & Market Leaders#GENIUSAct#CLARITYAct#STRC#SATA#StrategyInc#Strive

Top comments