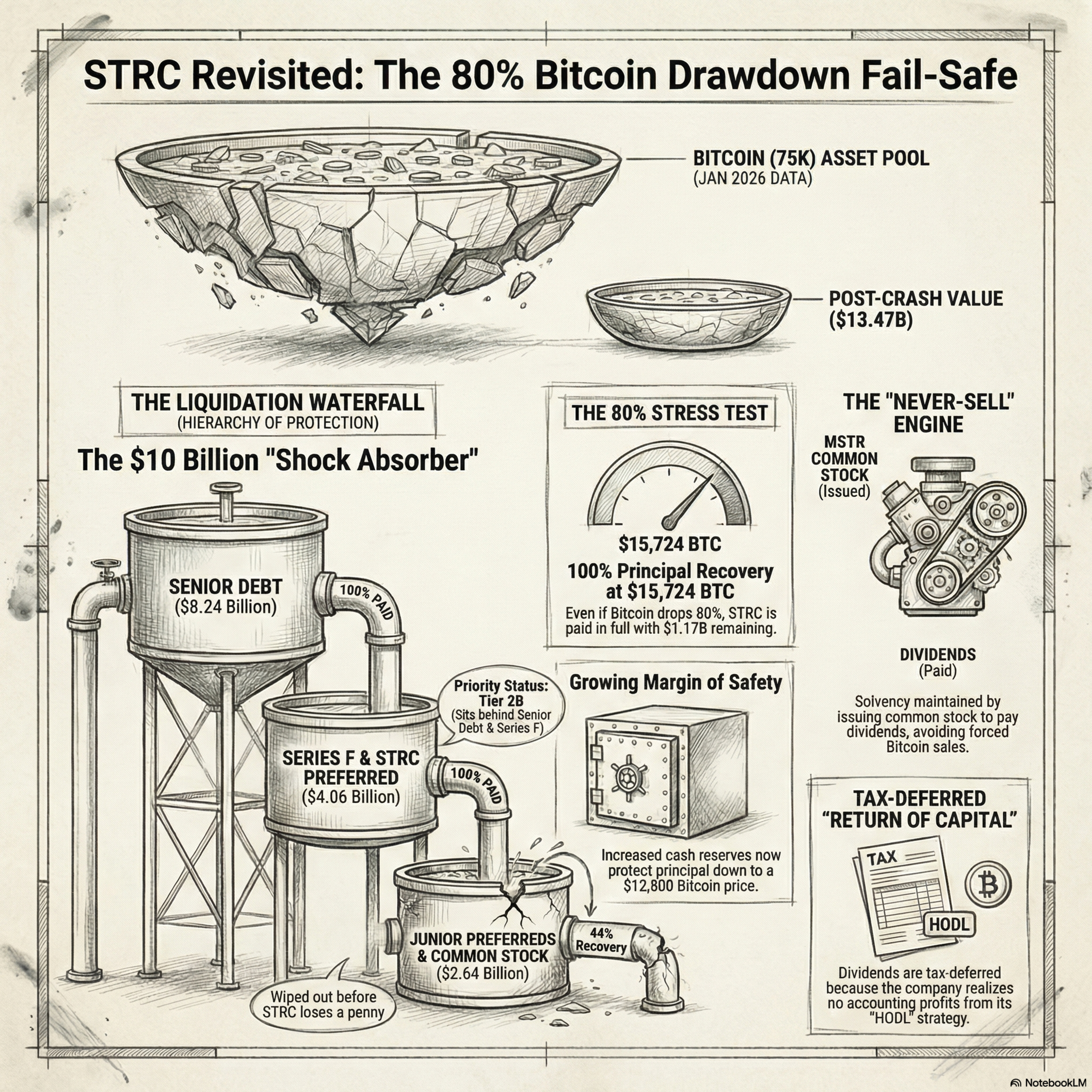

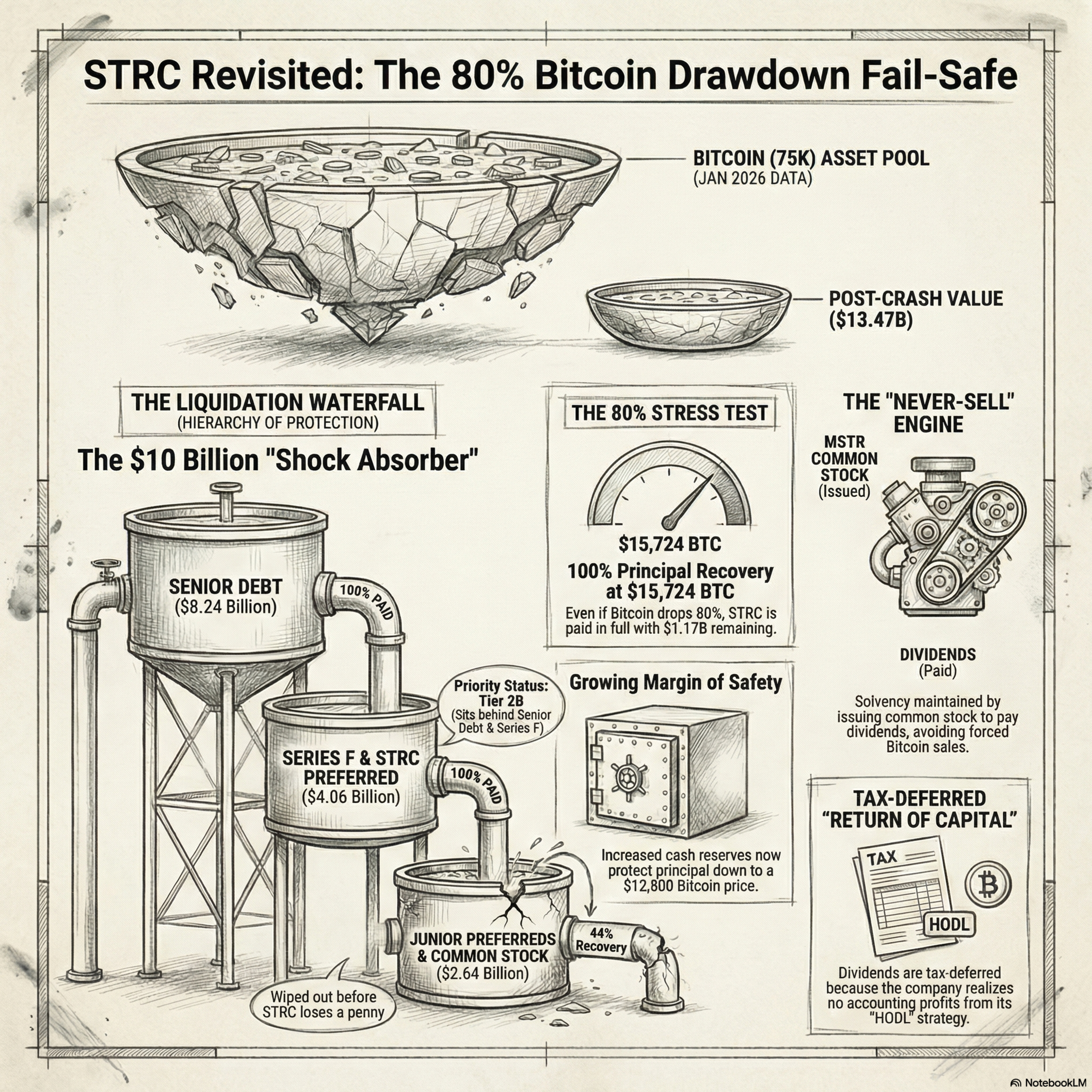

Referenced episode where we analyzed STRC through 80 % drawdown - Q3 2025This episode evaluates the stability of STRC preferred stock (when bitcoin is down to 75 K from ATH 125 K) , a unique investment vehicle designed to offer high-yield monthly dividends while shielding principal from the extreme volatility of the cryptocurrency market. By utilizing a "waterfall" liquidation analysis, the text demonstrates that the company's significant cash reserves and Bitcoin holdings provide a robust margin of safety, ensuring investors are paid even during a theoretical 80% market crash. A key appeal for the retail investor is the tax-deferred status of these payments, which are classified as a return of capital rather than immediate taxable income. Ultimately, the document serves to validate that the instrument’s mechanical stabilizers and structural priority successfully decouple consistent cash flow from the downward risks of digital assets.#STRC – The primary subject; a "preferred stock" designed to turn Bitcoin volatility into steady dividends.#StrategyInc – The company issuing the stock (often referred to as a "Bitcoin treasury company"),.#MSTR – The common stock ticker mentioned, which acts as a "leveraged call option" on Bitcoin and supports the preferred dividends via equity issuance,.#MichaelSailor – Cited in the text as the figure making the "80% drawdown" protection claims,.Financial Engineering & Structure#FinancialEngineering – Described as "alchemy" that transmutes Bitcoin's chaos into stability,.#CapitalWaterfall – The specific liquidation priority structure (Debt → STRF → STRC → Junior Preferreds → Common Stock) that protects principal,.#CircularFunding – The model where the company issues common stock (ATM) to pay dividends without selling Bitcoin,.#LiquidationPreference – Refers to the $2.80 billion priority claim STRC holders have on assets.Tax & Income Strategy#ReturnOfCapital (#ROC) – The classification of dividends that defers taxes until the asset is sold,.#TaxDeferred – Highlights the benefit for high earners pushing tax liabilities into the future,.#AdjustedCostBasis – The critical metric investors must manually track to avoid tax misreporting,.#HighYield – Refers to the 10–12% annual yield (adjusted to 11.25% in Jan 2026),.#NeverSell – The corporate philosophy that keeps "Earnings and Profits" negative, enabling the tax-deferred status,.Risk Management & Analysis#PrincipalProtection – The core claim that the investment is safe even if the underlying asset crashes.#80PercentDrawdown – The specific stress-test scenario used to validate STRC's safety,.#DeepDive – The format of the analysis provided in the transcript.#StressTest – The quantitative method used to prove the "fail-safe" mechanics,.Market Updates (2025-2026)#MarketUpdate2026 – Reflecting the new data from January 2026.#CryptoFinance – The intersection where digital assets meet corporate finance.#FailSafe – The term used to describe STRC's role for the retail investor.Meta/Production#Shutosha – The YouTube channel hosting the deep dive [Heading].#MosaicAI – The AI video editing tool mentioned by the creators for visualizing financial data.

See moreTop comments