#STRC at #BTC 8k - Liquidity & Solvency test - as claimed by Saylor

EpisodeFeb 1733m

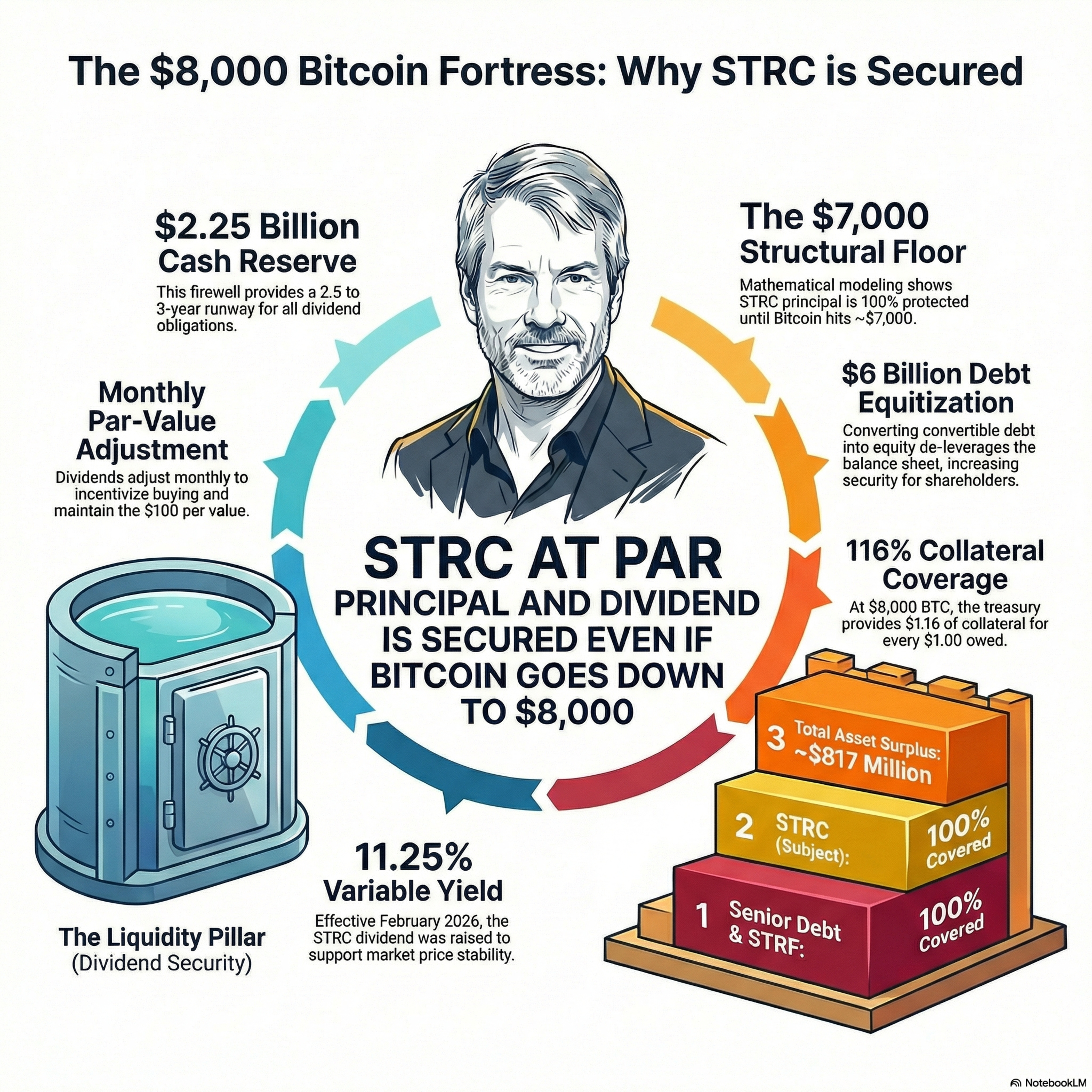

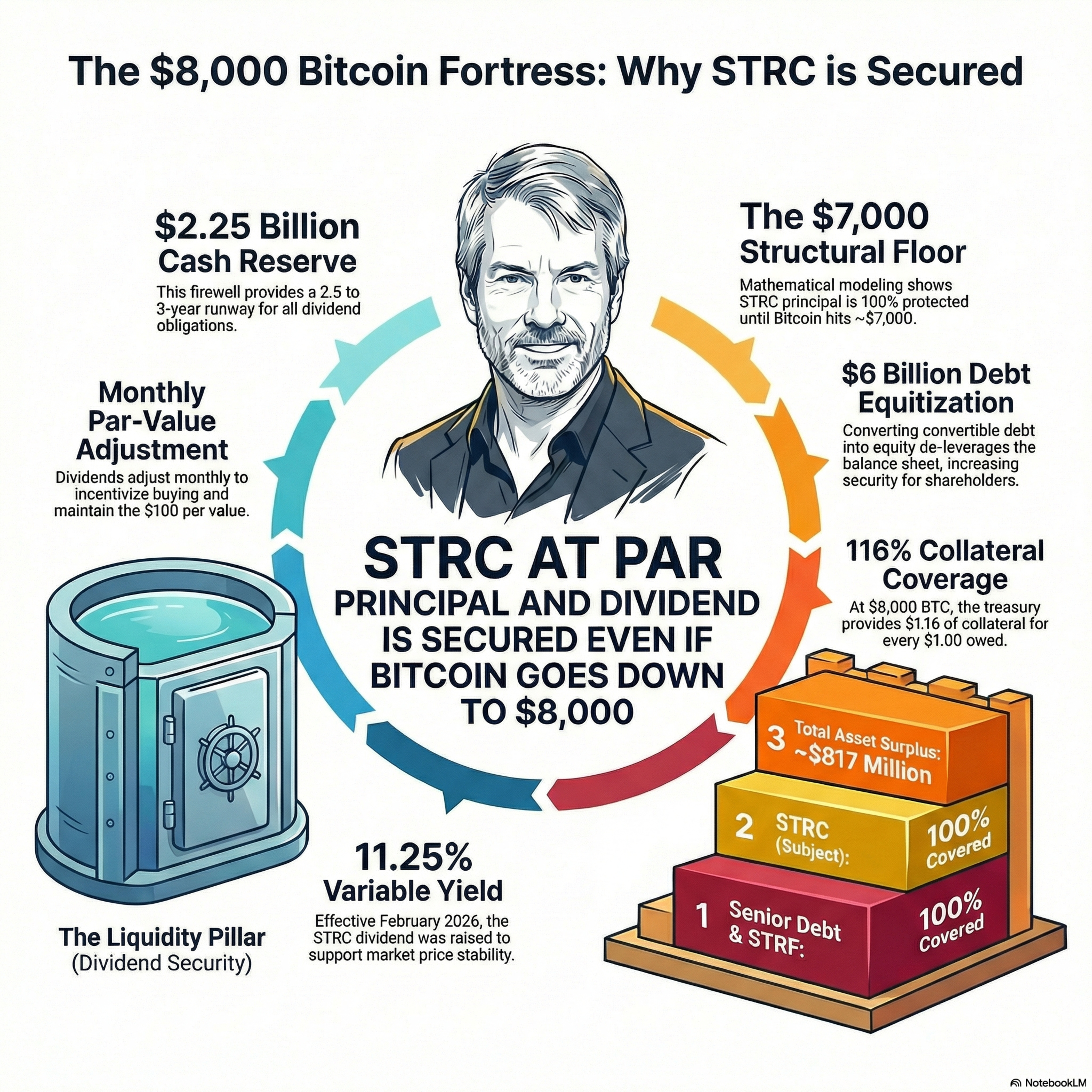

ResearchSTRC Course MosaicThe episode provides a technical analysis of Strategy Inc.’s financial stability, specifically examining its ability to survive a catastrophic Bitcoin price collapse to $8,000. The company utilizes a unique "digital fortress" treasury model, supported by a massive reserve of 714,644 Bitcoin and a multi-year cash buffer for dividend payments. A critical component of their survival plan involves equitizing $6 billion in debt, which converts creditors into shareholders to reduce balance sheet pressure. Financial modeling shows that even if cash reserves are fully exhausted, the priority of claims ensures that senior preferred shares remain fully covered by the remaining Bitcoin value. Ultimately, the documents argue that the company's structural floor is approximately $7,000, rendering its senior obligations mathematically secure despite extreme market volatility#StrategyInc – Referring to the company formerly known as MicroStrategy, which has transitioned into a "Bitcoin Development Company".#DigitalFortress – The term used to describe the company’s balance sheet, supported by a hierarchy of debt, equity, and USD liquidity.#BitcoinTreasury – Describing the massive holding of 714,644 BTC that serves as the primary asset backing the company's obligations.#TieredCreditEcosystem – The specific financial architecture Strategy Inc. uses, consisting of different layers of perpetual preferred shares (STRF, STRC, STRK, STRD).#StructuralFloor – The critical price point (~$7,000 - $8,000) where the Bitcoin treasury still fully covers senior obligations.#8kBitcoin – The catastrophic "stress test" price level used to validate whether the company can survive a massive market crash.#SolvencyPillar – The analysis of the company's survival capabilities assuming a "Spent Cash" scenario where reserves are exhausted.#NuclearWinter – The specific term used in the stress test model to describe a scenario with $0 cash reserves and Bitcoin priced at $8,000.#LiquidityFirewall – The $2.25 billion cash reserve maintained to pay dividends without having to sell Bitcoin.#STRC – The ticker for the "Series A Perpetual Stretch Preferred Stock," a mezzanine security central to the solvency analysis.#DebtEquitization – The strategic plan to convert $6 billion of convertible debt into equity over 3–6 years to de-leverage the balance sheet.#DividendRunway – The estimated 2.5 to 3 years of coverage provided by cash reserves to meet interest and dividend liabilities.#NAVDiscount – A market condition where the company's market cap drops below its Bitcoin value, incentivizing bondholders to convert to equity.#FourYearCycle – The market theory referenced by analysts suggesting the current downturn is a "mid-cycle correction" rather than a structural failure.#SaylorClaim – Referring to Michael Saylor's assertion that the company remains safe and solvent even if Bitcoin drops to $8,000.#MacroRotation – The observation that institutional investors are moving profits from Gold to Bitcoin, creating a "coiled spring" effect for the stock.

Top comments