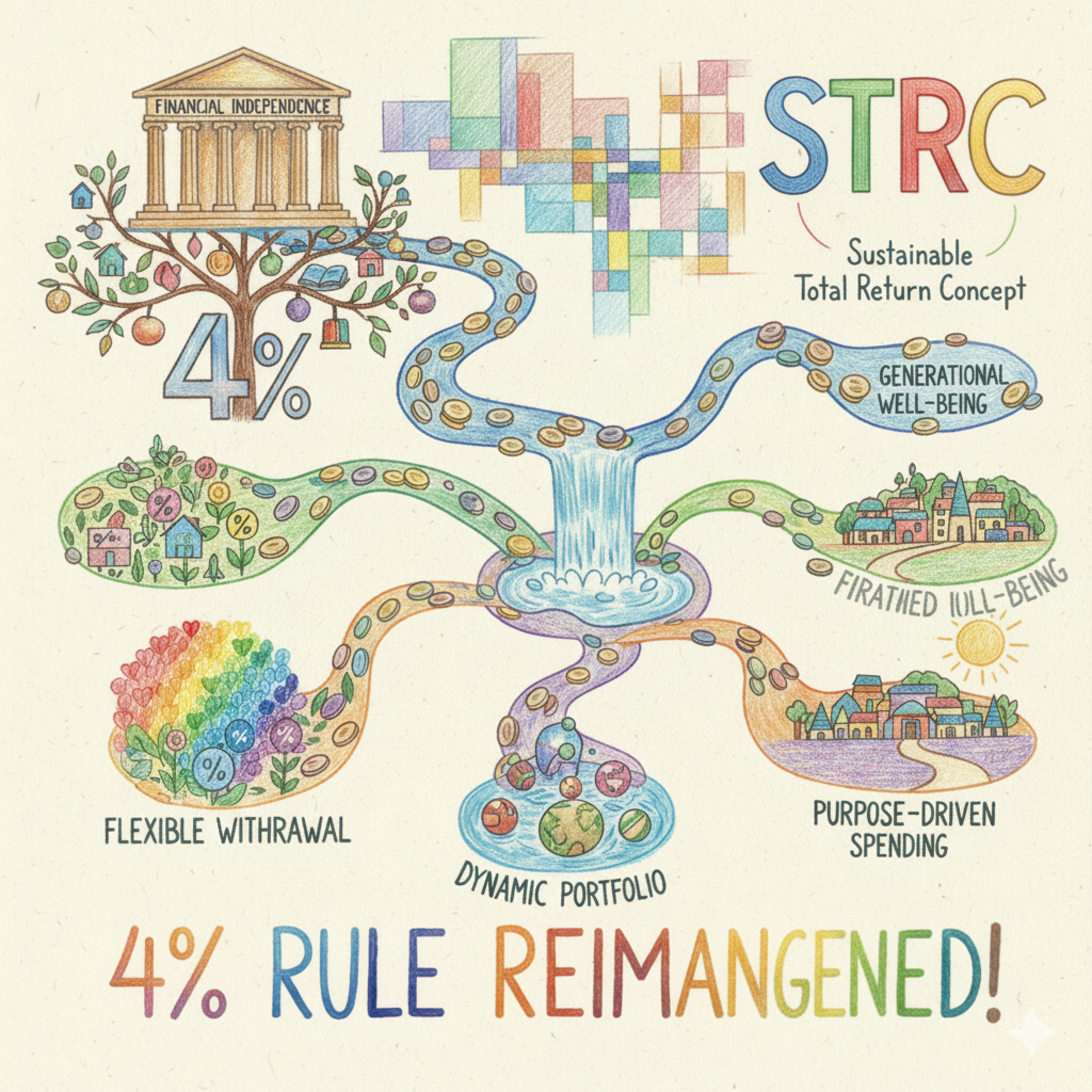

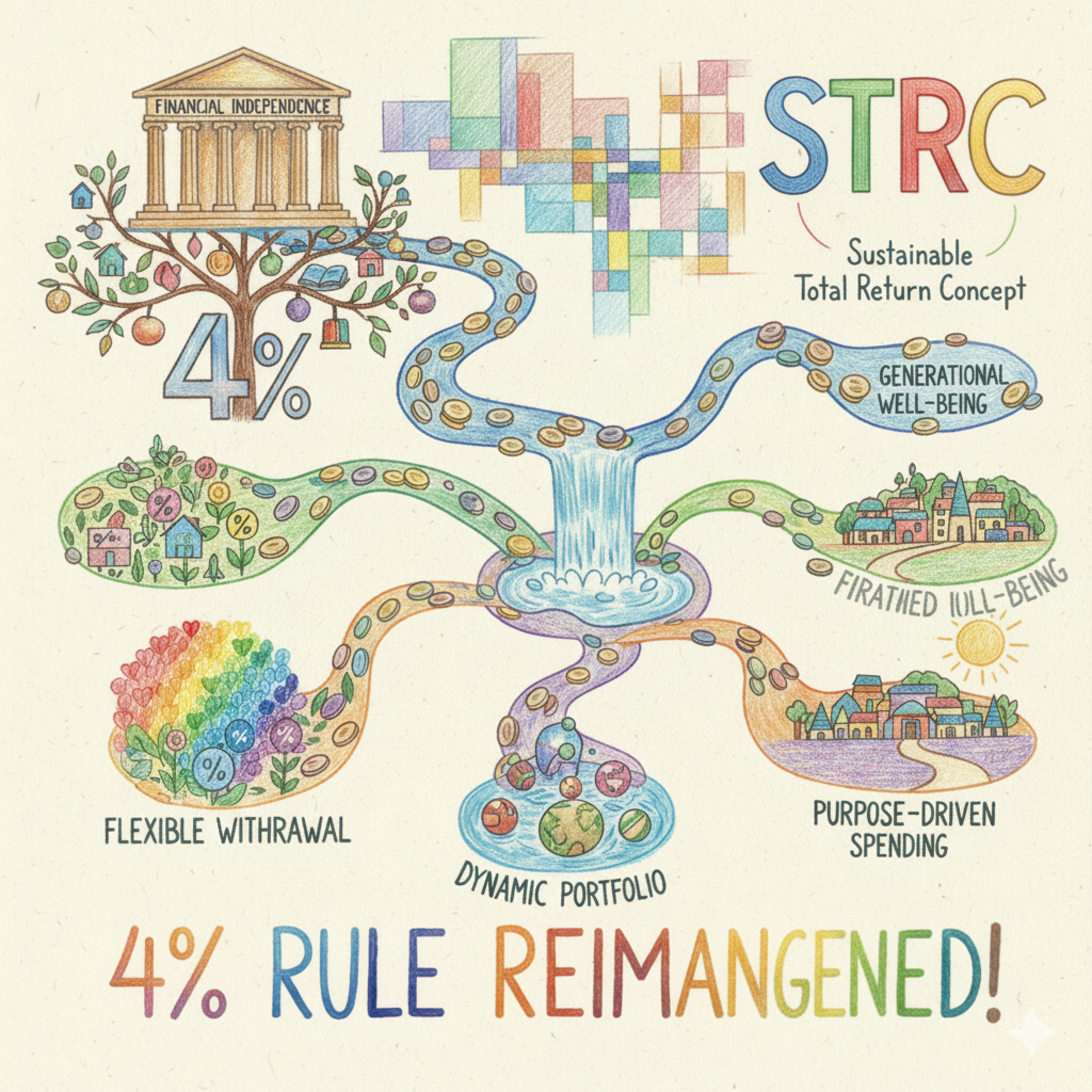

Check out open source Research !This financial blueprint outlines how a $1,000,000 principal in 2025 San Francisco secures a 10-year breakthrough window for high-leverage asset creation, rather than purchasing permanent retirement. This model directly rejects the established 4% Rule, which demands $2.5 million to safely generate comparable passive income for true "rest." The strategy relies on a rigorous "Triple Arbitrage" spanning capital, regulation, and space. The objective is not to retire, but to gain autonomy to build high-leverage assets, specifically within the AI production ecosystem.The financial core is Capital Structure Arbitrage using Strategy Inc (STRC) Series A Perpetual Stretch Preferred Stock. Strategy Inc is a "Bitcoin Treasury Company," which, due to its aggressive Bitcoin acquisition and related accounting complexities (impairment charges and the distinction between GAAP and tax earnings), frequently reports negative tax Earnings and Profits (E&P). This structural feature is critical to the tax arbitrage.The STRC stock yields 10.50% annually, generating a $105,000 cash flow stream monthly. The stock's "Stretch" provision automatically adjusts the dividend rate to stabilize the share price near its $100 par value. Crucially, because of the negative E&P, the distributions are legally classified as a Return of Capital (ROC), not taxable dividends. This critical tax invisibility generates a $0 Adjusted Gross Income (AGI) for the investor for approximately 9.5 years. The ROC reduces the investor’s cost basis rather than generating immediate tax liability.This $0 AGI is the lynchpin of Regulatory Arbitrage. By maintaining zero taxable income, the investor meets the requirements for California’s comprehensive, $0-cost healthcare program, Medi-Cal, which uses Modified Adjusted Gross Income (MAGI) for eligibility. ROC distributions are not added back into MAGI. Furthermore, California has eliminated asset tests for the MAGI Medi-Cal population, meaning the individual can hold the $1,000,000 in STRC stock while legally qualifying as "low income" for insurance purposes. This subsidy eliminates a line item that costs early retirees $15,000 to $25,000 annually and ensures $0 state income tax liability.The third pillar is Spatial Arbitrage via "Ultralight Urbanism" in San Francisco. The investor uses high-density, luxury micro-units (220–350 sq. ft.) in key AI hubs like SoMa (e.g., The Panoramic), with market rents around $2,450–$2,900 per month. This lifestyle maximizes access to intellectual networks and city infrastructure ("Third Place" lifestyle) while eliminating the significant costs of vehicle ownership (averaging $10,000/year savings).The model is defined as a "wasting asset" because the strategy is temporary, threatened by two "ticking clocks". The Tax Cliff hits around Year 10 when the ROC fully exhausts the stock’s cost basis. Subsequent distributions become Capital Gains, which ARE included in MAGI. This instant spike to $105,000 MAGI results in the immediate loss of Medi-Cal eligibility and a tax bill of roughly 24.3% (federal and state combined), cutting disposable income by 30-40% overnight. Additionally, high real inflation (estimated at 10%) rapidly erodes the fixed stipend, reducing its purchasing power to approximately $38,500 real value by Year 10.The goal is to leverage the $13,200 annual surplus and a dedicated $1,000 monthly budget toward the AI Creator Stack—specifically renting industrial-grade compute power (like NVIDIA H100 GPUs). This strategy provides the investor with over 60 hours per week of dedicated production time to generate equity upside before the financial floor collapses.#FIRE #FinancialIndependenceRetireEarly #TaxArbitrage #MAGI #MediCalHack #BitcoinTreasury #StrategyInc #HighYieldStocks #AIRevolution #SanFranciscoRealEstate #UltralightLiving #PassiveIncomeStrategies #WealthArbitrage #CapitalGainsCliff #NVIDIAGPU #STRC

Top comments